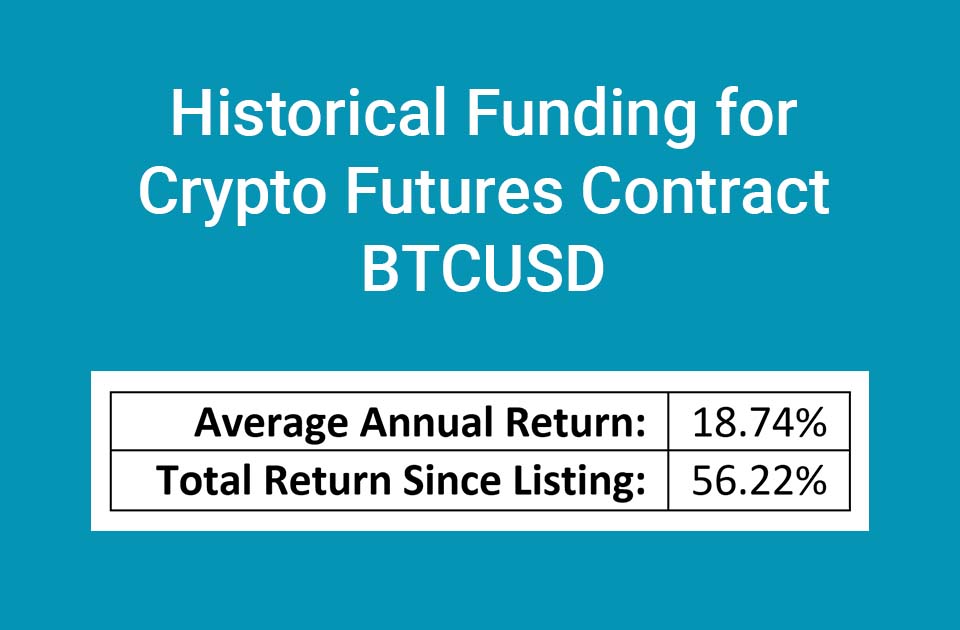

The above historical returns for funding are publicly listed and verifiable on the exchange referenced in this article. See details below.

Hedging is a valuable tool I use to profit in sideways and downwards moving Crypto Markets and also to manage risk in my Crypto portfolio. In this article, I'm going to discuss how I use hedging to generate returns from exchange funding.

Before we get into the details of the hedging strategy, you might be asking what funding is? Some, more innovative, Crypto exchanges have combined Cryptocurrencies with traditional financial products.

One of these new financial products are futures contracts for Bitcoin and a few of the larger Altcoins. These contracts might seem scary to the unfamiliar but Cryptocurrency exchanges have made them super easy to use. Without going into the technical details, funding is a little payment either paid to you or taken from you every 8 hours for using these contracts.

This will become clearer once we look at some examples, so let's look at some funding in action on an exchange now. There are a couple of exchanges that offer this but we are going to look at one of the biggest called Bybit .

If you are thinking of signing up to Bybit and like CryptoReturnCalculator.com, please use our link above. You will be supporting us to make more Crypto tools and articles like this one :)

How does funding works on Bitcoin To USD Contracts (BTCUSD)?

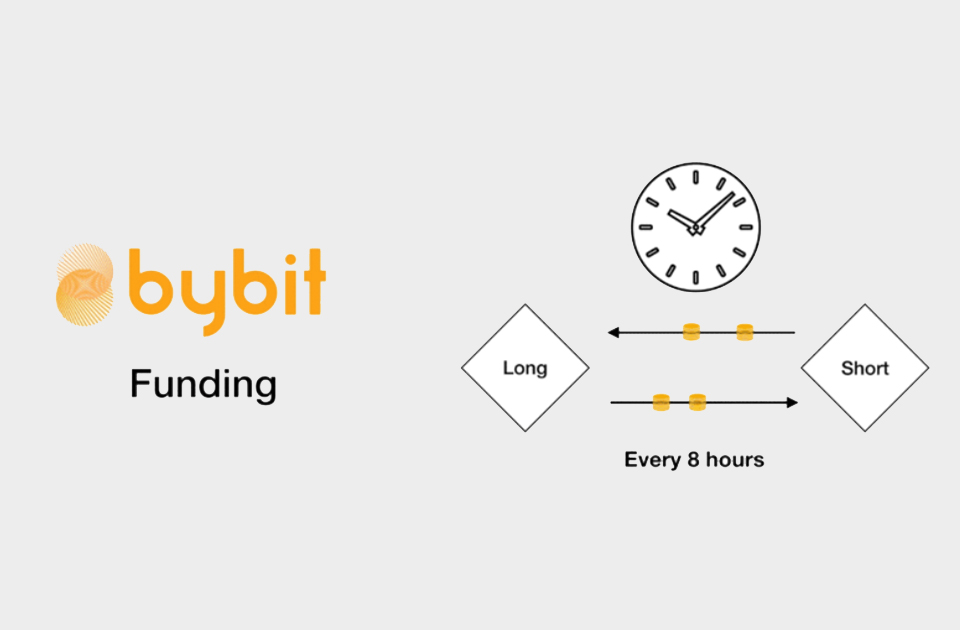

Bybit Funding Diagram

Bybit Funding Diagram

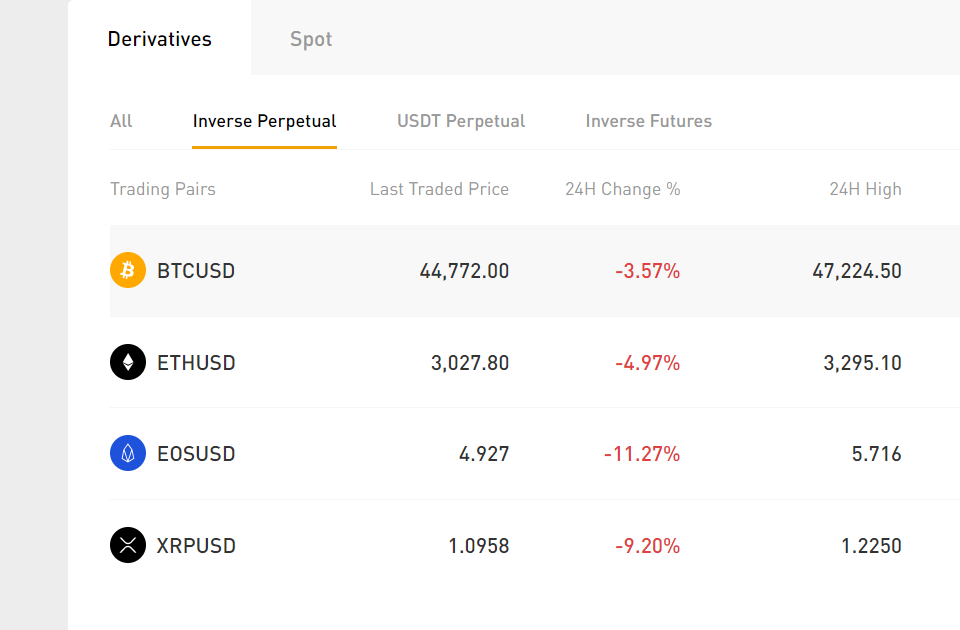

On Bybit future contracts, funding is exchanged directly between buyers (long positions) and sellers (short positions). For the Bitcoin Future Contract called BTCUSD, the funding gets paid every 8 hours at 04 o’clock, 12 o’clock, and 20 o’clock UTC . They also offer contracts for Etherium, EOS and XRP.

I also only use the Inverse Perpetual contracts because they are backed by the coin you are trading instead of Tether. This makes it easier to implement the hedging strategy that we will get to soon.

Bybit Inverse Perpetual Future Contracts

Bybit Inverse Perpetual Future Contracts

Why have this funding though?

The funding consists of two parts .

The first is the interest rate. After the calculations are done it ends up being 0.001% that the long positions have to pay to the short positions. This rate is constant and is why you often see the whole funding amount going to the shorts.

The second part of the funding amount that changes and is based on price fluctuations. One important thing to know about the contract price is that it does not have to match the real price (index or spot price) for that underlying Cryptocurrency.

For example, if Bitcoin is trading at $50,000 (index or spot price) the Bybit contract price could be at $50,500 or even $49,000.

Bybit do not actually make any money providing this funding feature. Again without getting too technical, they use funding as a way to match the Bybit contract price to the real price (index or spot price) of that Cryptocurrency.

How do they decide if the buyers (long positions) or sellers (short positions) get the funding?

The funding rate can be positive or negative. If this rate is positive, buyers (long positions) pay sellers (short positions). When the Funding rate is negative, sellers (short positions) pay long positions. They base it off whether the Bybit contract price is above or below the real price (index or spot price) of that Crypto.

For example, lets say the Bybit BTCUSD contract price is at $49,000 and the real Bitcoin price (index or spot price) is at $50,000. The BTCUSD price movement being below implies that there are too many sellers (short positions) on Bybit. Buyers (long positions) would be paid the funding and sellers would start exiting their positions to avoid paying this. This is why funding exists and how the BTCUSD is balanced back to the real Bitcoin Price.

How can you make money with funding if it is always balanced?

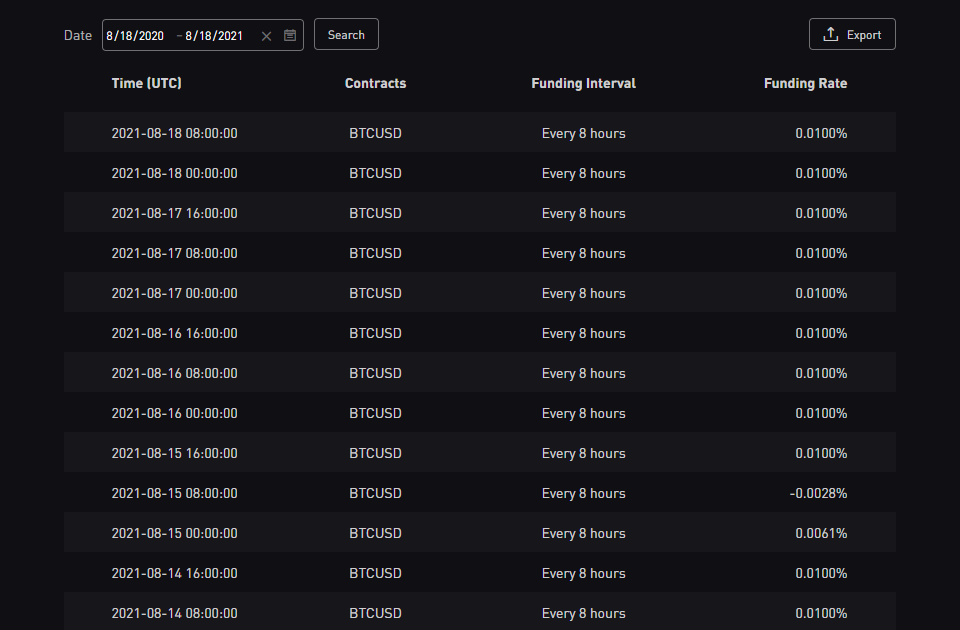

Bybit BTCUSD Funding Rate History

Bybit BTCUSD Funding Rate History

We can see from the above funding history from the last few days, every 8 hours a rate of 0.0100% was paid except twice with -0.0028% and 0.0061%. Remember, that if the rate is positive than the buyers (long positions) have to pay it to the sellers (short positions).

In my experience most of the time the rate sits at 0.0100% even when the BTCUSD price is moving downwards. I went ahead and searched all the historical funding year by year from the day I wrote this article:

Total funding for the most recent year (8/18/2020 - 8/18/2021) was 35.163977%.

The year before that (8/18/2019 - 8/18/2020) total funding was 11.327471%.

The final previous year started was when Bybit launched the contract (11/14/2018 - 8/18/2019) and 7.463414% was funded for this shorter time period.

It is clear that sellers (short positions) are historically receiving funding. If funding stays at its most constant funding amount of 0.0100%, you would receive around 10.95% per year in funding as a seller (short position).

How do you use a hedging strategy to get funding?

The hedging that I do is relatively simple. I hold the majority of my Crypto asset (long side) safe in my hard wallet and sell (short side) an identical amount using leverage on Bybit. The only Crypto I'll hold on Bybit is enough to cover the margin requirements for the leverage.

Shorting BTCUSD On Bybit

Shorting BTCUSD On Bybit

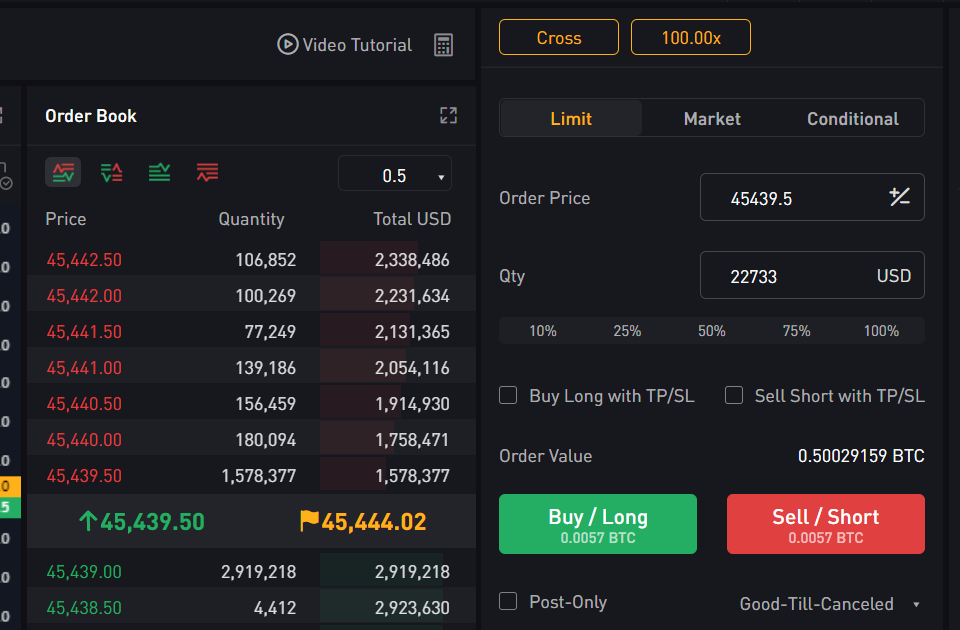

For example, lets say we have .5 Bitcoin and the current real price (index or spot price) today is $45,467. Like in the image above, I make a Limit Sell/Short for roughly half a bitcoin which is $22,733 USD. I'll probably have about 33% of my long in Bybit for Margin which is about 0.1666 BTC. Now I'm hedged both ways and I can collect funding without worrying about price fluctuations in Bitcoin or USD. If Bitcoin's price rises, half my money is in Bitcoin. Alternatively, if the USD rises half my money is in USD. They are balanced.

There are a few things I should note. In the above image, you can see at the top that I have selected Cross and 100.00x. The 100.00x means you are using margin up to 100 times. This means I don't have to deposit my whole .5 of a Bitcoin into Bybit to create the trade. I can keep it off the exchange in my secure hard wallet.

I also need to monitor the liquidation price and refund my Bybit account if it gets hit. If I get liquidated, it's not the end of the world. It just means I'll incur a few fees making the new position.

When do you use a hedging strategy like this?

Recent Few Months Of Sideways Movement in BTCUSD

Recent Few Months Of Sideways Movement in BTCUSD

I really only use this hedging strategy in two ways. When the Crypto I'm following is trending sideways or down on Bybit and also to diversify my portfolio.

So firstly, if the digital asset I'm following is trending down or sideways, than I'm not currently making money holding that coin. During these periods, I'll park my holdings in a hedge like I discussed above and then wait for the market to turn around. This hedging technique can protect me against downturns in the price because I am in both USD and Bitcoin. If the market is in a big downturn and funding is heavily negative, I would consider moving entirely to a USD Stablecoin to wait it out.

The second way I might use this hedging strategy is to diversify my portfolio. This is a lower risk strategy when compared to other Crypto strategies. As you would know, there is a lot of market volatility in Cryptocurrencies. Maybe i'll have around 25% of my portfolio in this hedging strategy to generate a steadier rate of return without the high variance of profits and losses.

If you're looking for some more technical math based ideas and analysis for your hedge trading, then check out the article Trading Strategies For Bitcoin Futures Premiums .

Disclaimer - This article is meant to provide factual information about trading strategies and concepts. It is not intended to be general or personal investment advice as I am not a qualified financial advisor. Always consider getting professional advice to see if a new investment is suitable for your circumstances.